You’ve likely seen how crypto and blockchain are changing the way we think about finance, making it digital, borderless, and decentralized. But it’s not just money that’s being reimagined. Blockchain technology is also transforming centuries-old assets like real estate, gold, and bonds into something far more accessible and efficient.

As of 2024, over $15 billion worth of traditional assets have already been brought on-chain through tokenization. This growing market spans everything from property and precious metals to government bonds and private credit. Tokenizing Real-World Assets (RWAs) simply means converting physical or financial assets into blockchain-based tokens that represent ownership. What makes this powerful is the shift from rigid, high-barrier ownership to fractionalized, programmable, and liquid assets. By doing so, anyone can easily buy, sell or trade them online.

What’s Driving the RWA Demand?

Well, you probably know that traditional assets make up a significant part of the global financial system but not everyone gets to invest or be part of that ecosystem.

- Real estate alone is estimated to be worth trillions of dollars. In fact, in 2023, the global real estate market was valued at $9.8 trillion.

- The gold market stood at $276.4 billion, growing at a CAGR of 5.8%.

But investing in these or other high-value assets like bonds and commodities usually requires a large upfront investment, layers of paperwork, middlemen, and dealing with regulatory or geographical barriers. All of this keeps many people out of the market, even if they want to be part of it. As a result, it’s mostly wealthy or high-net-worth individuals who get to invest, trade, and benefit from these markets.

Even after investing, liquidity is a major issue. These assets aren’t easily converted to cash, it’s often time-consuming, filled with paperwork, and complicated.

As the decade-old crypto market matures, many investors are realizing that asset-backed tokens help solve a key liquidity issue in crypto. Speculative, hype-driven tokens have added uncertainty to the space. The lack of real-world utility in many of these tokens has triggered growing demand for projects grounded in real assets, ones people can trust, understand, and trace.

How Tokenizing Real-World Assets Can Unlock Trillions?

With blockchain already opening up access to finance through crypto, it’s now doing the same for traditional assets. Let’s understand how tokenizing real-world assets can unlock trillions.

The Scale of Traditional Asset Markets

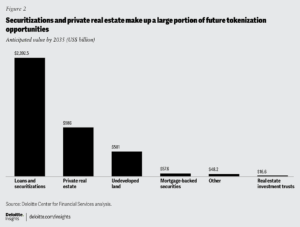

With the growing market size of real estate ($14.5 trillion by 2030), gold ($457.91 billion by 2032), and other asset classes like the commodities market ($158 trillion by 2029), tokenization has only just begun. As institutions enter the space and investor demand for stable, asset-backed crypto grows, the tokenized real-asset market is poised for significant expansion. One study highlights that tokenized ownership of loans and securitization could grow to $2.39 trillion by 2035, while tokenized private real estate is expected to reach $1 trillion by the same year.

Global Accessibility and Automation

RWAs truly unlock cross-border asset investment and trading. Using your crypto wallet, you can invest in assets like Manhattan real estate or London gold vaults without needing intermediaries, borders, or physical presence. For example, CitiBank has already initiated a proof of concept to tokenize private equity funds, aiming to enhance liquidity and accessibility in the private equity sector through blockchain technology. RWAs bring trillions of off-chain value on-chain. With smart contracts, they reduce manual processing, increase transparency, and enable programmable compliance.

Liquidity Unlock

Enhancing liquidity and efficiency through asset tokenization is another reason RWAs are gaining traction. Tokenization enables fractional ownership, meaning smaller investors can enter the space, resulting in more buyers and greater liquidity. Just imagine turning a $10 million building into 10 million $1 tokens.

Forecasts and Institutional Adoption

Institutions have also recognized the potential of the RWA sector and have begun enhancing investor accessibility and creating new trading opportunities. Experts predict that RWAs will attract mainstream institutional investors, with some reports estimating a $10 trillion market by 2030. Another recent report from Security Token Market goes even further, forecasting $30 trillion in asset tokenization by 2030.

The adoption of RWAs since 2017 is aligning with these forecasts, with almost every asset class now brought on-chain. In fact, some of the world’s biggest financial institutions have already started making serious investments in the tokenization space. Today, over $50 billion worth of stocks, bonds, and real estate are tokenized, and tokenized dollars or stablecoins have reached the value of $200 billion.

The Expanding RWA Frontier

The RWA industry is expanding. Other use cases include tokenizing carbon credits, agricultural land, renewable energy credits, luxury watches, art, and more. RWAs aren’t just transforming finance — they’re entering sectors like supply chain, ESG, and sustainability.

That said, there’s a clear shift toward utility-driven tokens, those not only backed by real assets but also grounded in strong ethics and long-term principles.

Why Ethical RWAs Could Make a Greater Shift?

At Caiz, we bridge this gap with a focus on ethical finance, security, and blockchain innovation. But it’s not just about making assets accessible to anyone with a smartphone or internet connection. It’s also about reaching the 1.4 billion people around the world whose access to modern finance is limited not by technology, but because the current systems often fail to respect their religious and ethical beliefs.

Our RWA projects, whether focused on real estate, bonds, gold, securities, or commodities like oil, are built on the principles of Sharia law. Every product at Caiz is free from interest (riba) and is backed by real, utility-based assets, removing the uncertainty and speculative nature from the system.

Since Caiz is rooted in Islamic values, every aspect of our business operations is ethical, safe, and free from any form of gambling or prohibited activities. While tokenized RWAs already bring the value of real assets on-chain, making them more accessible, affordable, and borderless, RWAs by Caiz go a step further, making them more ethical, fair, and equitable for everyone.